ASMRInstitutional Expansion in Partnership with the Middle East Venture Capital Association (MEVCA)

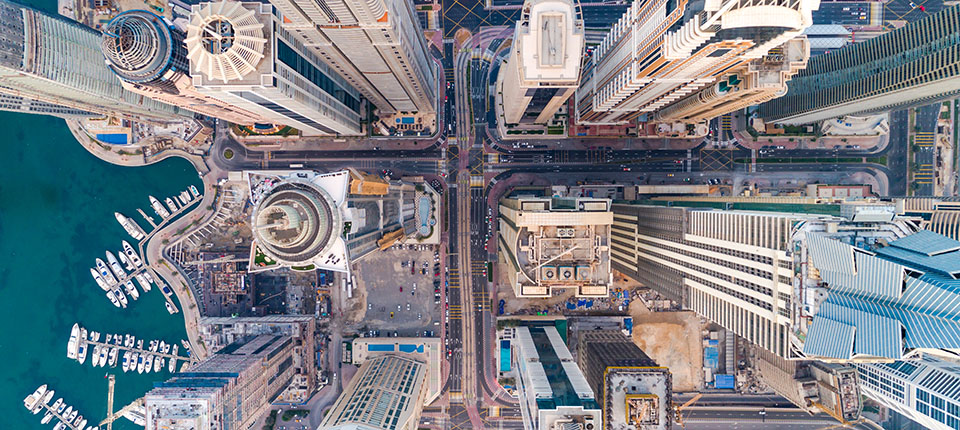

On 27 November 2023, GPCA CEO Cate Ambrose was in Abu Dhabi to announce an important new institutional expansion in the region in partnership with the Middle East Venture Capital Association (MEVCA).

The partnership between GPCA and MEVCA highlights the region’s dynamic investment landscape, showcasing how the UAE’s investor-friendly policies and regulatory reforms are attracting global private capital investors. Read the press release here.

Members can access GPC Analytics for a ten-year archive of Middle East private capital transactions and data cuts.

Research Team

Jeff Schlapinski, Managing Director, Research

Tatia Dzaptashvili, Analyst, Research

Middle East Research

2024 Trends in Global Tech

21 March 2024GPCA markets are searching for a new normal. After an unprecedented wave of activity during COVID-19, venture capital (VC) deal value and count fell for the second straight year in… Read More

Tracking Cross-Border Private Capital: New Links Between Asia and the Middle East

27 February 2024Strengthening diplomatic relations, economic integration and strategic technology transfers are reshaping the private capital investment landscape between the Middle East and Asia. Investors and portfolio companies in Asia are increasingly… Read More

2024 Industry Data & Analysis

20 February 2024GPCA’s 2024 Industry Data & Analysis features in-depth private capital data, commentary and analysis on key trends across global markets. Key data takeaways: Overall private capital deal value across GPCA’s markets… Read More

2023 Trends in Global Tech

21 February 2023Overview GPCA’s annual Trends in Global Tech report traces venture capital flows across Africa, India, China, Southeast Asia, Latin America, Central & Eastern Europe and the Middle East. Amidst a… Read More

2023 Industry Data & Analysis

21 February 2023Private capital investment activity across GPCA’s markets remained strong by historical standards in 2022, with fund managers deploying USD208b. Overall deal value declined 22% from 2021, yet 2022 was still… Read More

2022 MENA Data Insight

7 September 2022The global digital revolution has breathed new life into the Middle East and North Africa (MENA) private capital industry following a long stretch of low activity. Additional analysis includes: A… Read More

2022 Global Private Capital Industry Data & Analysis

16 February 2022GPCA Members can log in to download the complete 2022 Industry Data & Analysis Excel file. GPCA data through year-end 2021 across Asia, Latin America, Africa, CEE and the Middle… Read More

Mid-Year 2021 Global Private Capital Industry Data & Analysis

16 September 2021GPC 1H 2021 data on fundraising, investment and exit activity across Asia, Latin America, Africa, CEE and the Middle East Key data takeaways: All major markets posted year-over-year gains… Read More

2021 Climate Data Insight

2 November 2021Based on GPCA’s newly developed taxonomy of climate-dedicated businesses, the 2021 Climate Data Insight covers climate-focused private capital activity in Asia, Latin America, Africa, Central & Eastern Europe and the… Read More

2021 Trends In Global Tech

25 May 2021Investments in Africa, Asia, CEE, Latin America and the Middle East EMPEA’s 2021 report on global venture investment traces venture capital (VC) flows across Africa, Asia, CEE, Latin America and… Read More

2021 Data Insights

31 March 2021Data Insights The 2021 Data Insights feature data and analysis on private capital activity in China, India, Southeast Asia, Africa and Central & Eastern Europe (CEE) through year-end 2020. This year, members also have access to LAVCA’s… Read More

Middle East Data Insight (Mid-Year 2019)

27 September 2019EMPEA Members, log in and click through for your exclusive access to the detailed report and underlying data. The private capital space in the Middle East has undergone a transformation over the… Read More

Middle East Data Insight (Year-End 2018)

11 March 2019EMPEA Members, log in and click through for your exclusive access to the detailed report and underlying data. Managers deployed USD516 million in the Middle East in 2018, representing a 102%… Read More

Africa and Middle East: An Overview of Select Markets’ Government Response to COVID-19 and State-Sponsored Relief Programs

8 June 2020Contributed by EMPEA Leadership Circle and Legal and Regulatory Council member, Debevoise & Plimpton Read More

2019 Global Limited Partners Survey

3 May 2019The 15th annual edition of EMPEA’s Global Limited Partners Survey features the views of 104 limited partners (LPs) on the current conditions and outlook for emerging market private equity (EM… Read More

Middle East News

Foursan Group Acquires 33% Stake in Jordan’s Medjool Village

Foursan Group acquired a 33% stake in Medjool Village, a Jordan-based Medjool dates supplier. Read More

Amethis Acquires Minority Stake in UAE’s BBI

Amethis acquired a minority stake in BBI, a UAE-based data management consultancy firm in the MENA region. Read More

Ezdehar Management Acquires Majority Stake in Egypt’s SETA Textiles

Ezdehar Management acquired a majority stake in Egypt-based apparel retailer SETA Textiles. Read More

Gulf Capital closes strategic sale of AmCan

Gulf Capital fully exited AmCan, a UAE-based sports nutrition distributor, to a regional FMCG distributor operating across the Middle East and Africa. Gulf Capital first invested in AmCan in 2016. Read More

Global Ventures Leads USD3m Pre-Series A for UAE’s Maalexi

Global Ventures led a USD3m pre-Series A for Maalexi, a UAE-based risk management platform for SMEs in agriculture, with follow-on from Rockstart and Ankurit Capital. Read More

Milestone Strategic Partnership – Global Private Capital Association and Middle East Venture Capital Association to Collaborate

Announced at Abu Dhabi Finance Week – GPCA to have a permanent, significant presence in the UAE Abu Dhabi, UAE – 29 November 2023: The Global Private Capital Association (GPCA)… Read More

Global Ventures Leads USD20m Series B for UAE’s Immensa

Global Ventures led a USD20m Series B for Immensa, a UAE-based additive manufacturer, with participation from Endeavor Catalyst, Shorooq Partners and Green Coast Investments. Read More

Fajr Capital Leads Consortium To Acquire 65% Stake in UAE’s Aster DM Healthcare

Fajr Capital led a consortium to acquire a 65% stake in the GCC operations of Aster DM Healthcare, a UAE-based full spectrum private healthcare provider. Read More

Brookfield to Acquire UAE’s Network International Holdings for ~USD2.8b

Brookfield Asset Management agreed to acquire Network International Holdings, a UAE-based payments solutions provider for consumers, for GBP2.2b (~USD2.8b). Read More

Asian Development Bank To Provide USD174m of Loans to Saudi Arabia’s ACWA Power

The Asian Development Bank agreed to provide USD174m of loans to Saudi Arabia-based energy company ACWA Power to develop two wind power plants in Uzbekistan. Read More

Saudi Arabia’s Hakbah Raises USD2m Pre-Series A

Hakbah, a Saudi Arabia-based financial savings platform, raised a USD2m pre-Series A from Global Ventures and Aditum Investment Management. Read More

Connecting Fund Managers with Impact Investors’ Tax Principles

The purpose of this article is to initiate communication between multilateral and bilateral development finance institutions (‘’DFIs”) and private equity fund managers (“FMs”) that seek to attract DFI funding for… Read More